Phillips - Editions & Works on Paper

April 16th to 17th, 2024 - New York

Executive Summary

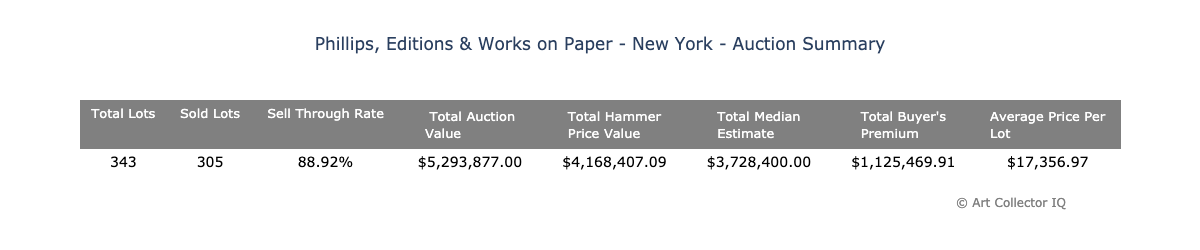

The "Phillips, Editions & Works on Paper - New York" auction presented a vibrant and varied collection of works, demonstrating a healthy art market with enthusiastic collector engagement across multiple price ranges. The auction featured 343 lots with an 88.92% sell-through rate, resulting in a total auction value of $5,293,877.00. Andy Warhol's pervasive influence was strongly felt, with his pieces achieving the highest total sales. High-performing lots surpassed median estimates, indicating a market favorable to sellers, while the distribution of sold lots revealed a market driven by both high-value transactions and a solid mid-range collector base.

Key Insights

- Sell-through Rate: With an 88.92% sell-through rate, the auction showcased a strong demand for works on paper, reflecting healthy market conditions.

- Andy Warhol's Market Impact: Warhol's works dominated both the top sales by total hammer price and the number of lots sold, underscoring his status as a blue-chip artist with broad appeal.

- Middle Market Strength: The $1,000 - $50,000 price range was particularly active, indicating a robust middle market with considerable liquidity.

- High-Value Sales: Works priced over $100,000 accounted for a significant portion of the auction's total value, highlighting the impact of high-caliber artworks on overall revenue.

- Average Prices vs. Volume: There was a notable variation in average prices per artist, with Jean-Michel Basquiat and Donald Judd commanding the highest average prices, signifying the premium placed on rarity and cultural significance.

- Unsold Works: The presence of unsold lots, particularly by artists like Sam Francis and Terry Winters, suggests a reassessment of their market position or valuation may be necessary.

Auction Overview

The auction held by Phillips, Editions & Works on Paper in New York had a total of 343 lots presented, out of which 305 lots were successfully sold. This resulted in a sell-through rate of 88.92%, which is quite robust and suggests a high level of interest from the buyers.

However, when comparing the total median estimate of $3,728,400.00 against the total hammer price value of $4,168,407.09, we can observe that the auction outperformed expectations. The total hammer price exceeded the total median estimate by approximately 11.8%. This discrepancy typically indicates that the lots on offer were either highly sought after, or that the estimates were conservative, resonating well with the market sentiment and resulting in competitive bidding.

Furthermore, it's notable that the Total Auction Value, which includes the buyer's premium, stood at $5,293,877.00. Given that the buyer's premium is typically 27% at Phillips, we can deduce that the buyer's premium amounted to approximately $1,125,469.91, aligning with the figures provided. This premium, when added to the hammer price, completes the Total Auction Value, indicating that the auction house was able to achieve a significant additional income from the sales.

The Average Price Per Lot was calculated to be $17,356.97. This figure serves as a general indicator of the value of the artworks traded during the auction and reflects the overall market value of the lots offered.

Lot Analysis

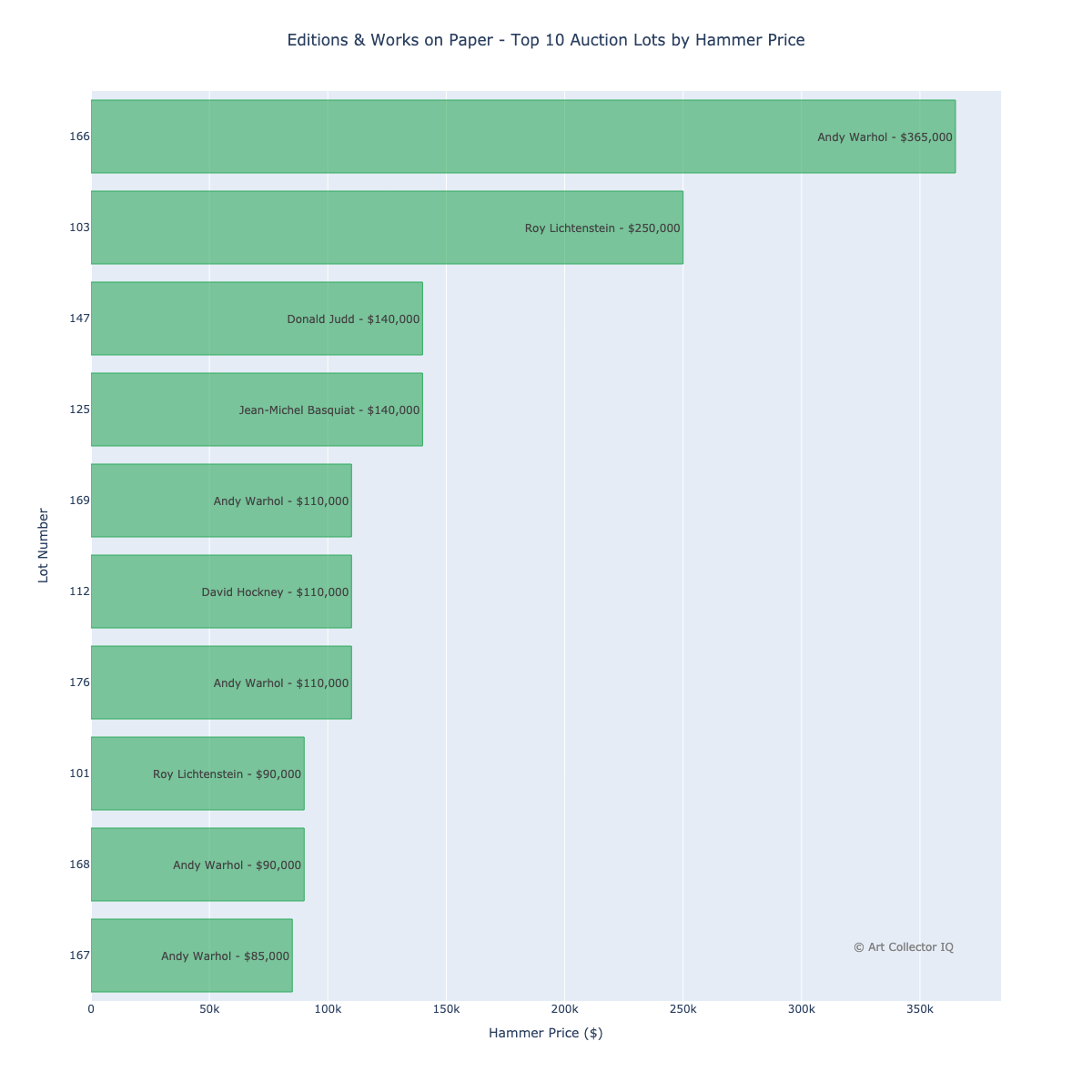

The chart of the top 10 auction lots by hammer price from the "Phillips, Editions & Works on Paper - New York" auction reveals several noteworthy points. It is dominated by works from the renowned artists Andy Warhol, Roy Lichtenstein, Jean-Michel Basquiat, Donald Judd, and David Hockney. This selection suggests that collectors remain drawn to iconic figures of 20th-century art, particularly those associated with movements like Pop Art.

At the pinnacle of the auction, with a hammer price of $365,000, is Lot 166, Andy Warhol's "Moonwalk (F. & S. 405)" from 1987, which significantly surpassed its median estimate of $150,000. The interest in this lot is emblematic of Warhol's enduring appeal and the particular fascination with his works that intersect popular culture and history.

Roy Lichtenstein's "Roommates, from Nudes Series (C. 282)", which fetched $250,000, showcases the artist's persistent market strength, despite not reaching its higher median estimate of $300,000. This work from 1994, placed as Lot 103, indicates that while Lichtenstein's work is highly valued, estimating its market price can present challenges.

Jean-Michel Basquiat's "Untitled (from Leonardo)" represents another artist whose market remains robust, with Lot 125 achieving a hammer price of $140,000, almost double its median estimate of $75,000. This impressive result underscores the market's strong appetite for works by Basquiat, whose pieces continue to resonate deeply with collectors.

Donald Judd's untitled work from 1991-1994, Lot 147, also achieved a hammer price of $140,000, greatly exceeding its median estimate of $60,000. This result reflects the high regard for Judd's minimalist approach and the significance of his works in the context of modern art.

Another Warhol piece, "Details of Renaissance Paintings (Sandro Botticelli, Birth of Venus, 1482) (F. & S. 317)", Lot 176, and David Hockney's "An Image of Gregory, from Moving Focus (T. 285), M.C.A.T. 276", Lot 112, each sold for $110,000. Both lots achieved a sale price close to double their median estimates of $75,000 and $60,000, respectively, revealing the strong performance of works by these artists at the auction.

Other Warhol pieces, "Marilyn (F. & S. 26)", "Sitting Bull, for Cowboys and Indians (see F. & S. 376)", and "Turtle (F. & S. 360A)"—lots 169, 168, and 167—consistently surpassed their estimates, confirming Warhol as a highlight of the auction. The least expensive in the top 10, however, Roy Lichtenstein's "Road Before the Forest, from Landscape Series (G. 1255, C. 213)", Lot 101, close to its median estimate, hammering at $90,000, suggesting a steady rather than explosive market interest for this piece.

These results not only indicate a robust market for works by these significant artists but also reveal that the estimates were conservative compared to the final hammer prices. It suggests an auction strategy that might be designed to encourage competitive bidding by setting lower estimates to attract a broad base of interested buyers, leading to final sales that significantly exceed expectations.

The lot that stands out with the highest percentage over its median estimate is Lot 282 by Andy Warhol titled "Pear," which sold for $15,500 against a median estimate of $3,000, marking a staggering 517% of the median estimate. This piece, created in 1957, showcases Warhol's artistic versatility and collectors' high interest in his earlier works, indicating a significant historical and collectible value attributed to it.

Following closely is Lot 359 by Evan Holloway, "Head Lamp," which fetched $4,800 on a median estimate of $1,000, reaching 480% of the median estimate. As a more contemporary piece from 2013, the interest in Holloway’s work suggests a strong following for his unique approach to sculpture and form, perhaps driven by recent exhibitions or a surge in market interest.

Keith Haring’s "Into 84 Exhibition Poster," Lot 372, also performed remarkably, realizing $3,200 from a median estimate of $750, reaching 427%. This result may reflect the enduring popularity of Haring's work and the desire of collectors to obtain pieces related to significant cultural moments of the 1980s.

Other notable performances include two additional lots by Andy Warhol: "Happy Birthday to You from Me" lot 272, and "Happy Butterfly Day" lot 278, achieving 400% of their median estimates. These sales reinforce the strong market for Warhol’s works, especially those with a playful or personal subject matter that resonates with collectors on an emotional level.

Notably, the list includes a diversity of mediums, from Warhol's unique ink blot drawing to Haring's offset lithograph poster, indicating that collectors are not solely focused on traditional mediums but are willing to invest in a variety of artistic expressions.

The success of Alexander Calder's "Circus," Lot 236, at 250% over its median estimate, and David Hockney’s "Pool Made with Paper and Blue Ink for Book," Lot 294, at 204% over estimate, highlight the continued collector interest in artists who have made substantial contributions to modern art, regardless of the medium.

It is insightful to see how the works of deceased artists have exceeded expectations to such a degree, suggesting that the legacy and art historical significance of these artists contribute significantly to the value assigned by collectors and the art market.

Let's look at the underperformers, starting with Pablo Picasso's "La famille de saltimbanques au macaque, from La Suite des saltimbanques (The Family of Macaque Acrobats, from The Acrobats Suite)" (Lot 203), which garnered $1,500 against a median estimate of $4,000, achieved only 38% of the expected price. This result, for a work by such a monumental figure in art history, might indicate that this particular print was either less known, not in vogue, or perhaps there was an abundance of similar works in the market, diluting its rarity.

Lot 151, an untitled piece by Robert Rauschenberg, fetched $5,000 on a median estimate of $12,500, also achieving just 40% of the median. As a significant figure in the post-war art scene, this outcome may suggest that this specific work did not resonate as strongly with collectors or lacked the characteristic features for which Rauschenberg is celebrated.

Cecily Brown's untitled work (Lot 111) achieved a similar fate, selling for $12,000, which was 40% of its $30,000 estimate. Brown's market can be quite polarized; although her work is generally well-received, this particular piece's performance suggests that it may not have aligned with collectors' expectations or prevailing trends.

Salvador Dali's "Le Cercle viscéral du cosmos, from La Conquête du cosmos (The Visceral Circle of the Cosmos, from The Conquest of the Cosmos)" (Lot 200) and Hans Hofmann's "Untitled (three drawings)" (Lot 237) both reached only 40% of their median estimates. Dali and Hofmann both have distinct collector bases, but these results may reflect the specific appeal or perceived value of the individual lots offered, rather than their overall market standing.

Marc Chagall, another artist with significant historical impact, has two lots, 194 and 192, achieving 47% and 50% of their median estimates, respectively. Chagall's work has a dedicated following, yet these particular pieces did not seem to ignite competitive bidding, potentially due to their abundance in the market or the specific tastes of the bidders present.

Alberto Giacometti's "Studio with Annette, from La Double Vue (The Double View)" (Lot 228), another lot that underperformed, achieved 50% of its median estimate. Despite Giacometti's reputation, this print might have suffered from market saturation or the specific collector interest in his more iconic sculptural works.

It's insightful to note the presence of two Picasso lots, 203 and 205, among the bottom performers, which is intriguing given the artist's general market strength. It suggests that even the works of high-caliber artists are not immune to market fluctuations and collector biases.

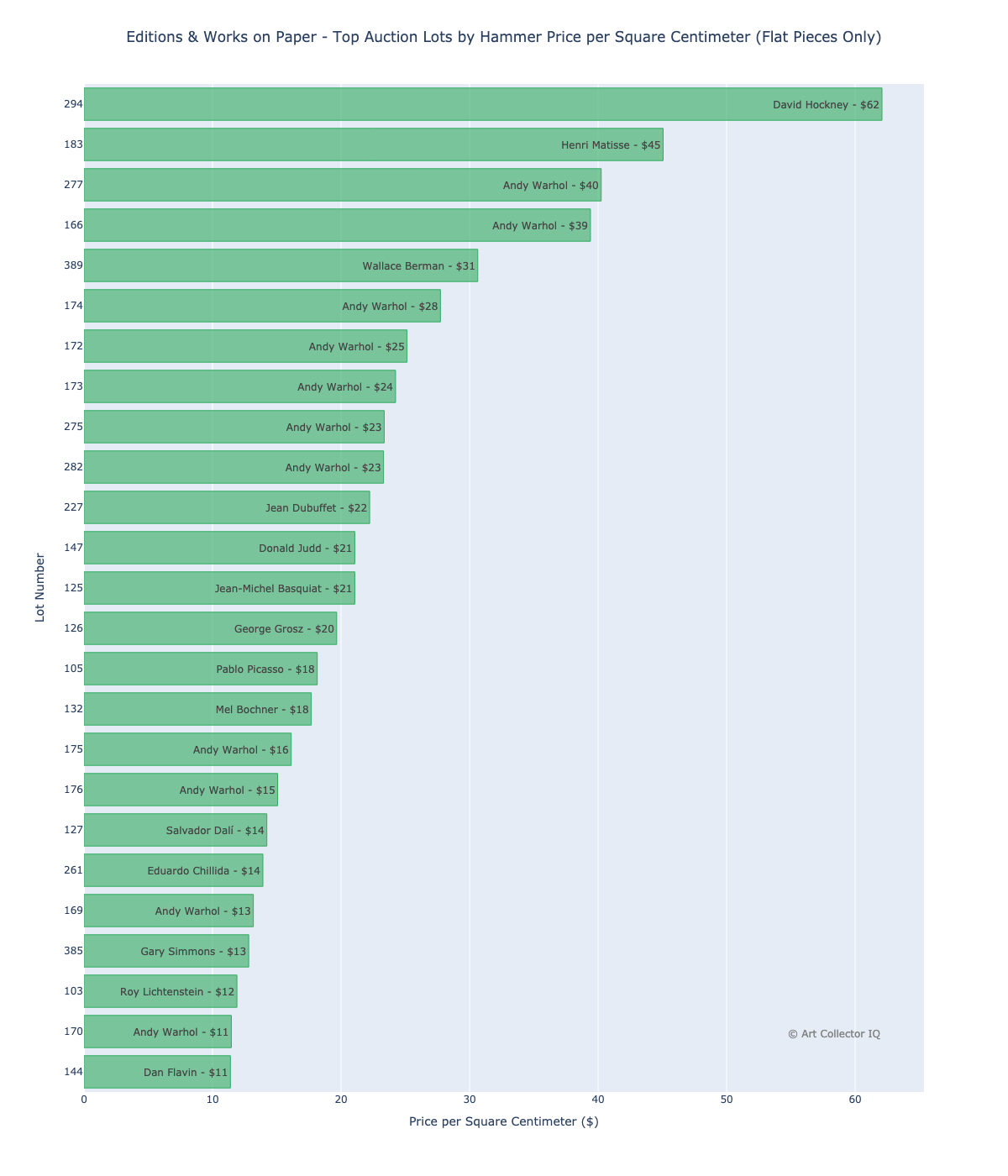

The chart below offers an interesting perspective by listing the top auction lots by price per square centimeter, which can be considered a measure of value density. This allows us to assess not just the total price artworks fetched but how much value collectors attribute to each unit of an artwork's size.

The lot that commanded the highest price per square centimeter is Lot 294 by David Hockney, titled "Pool Made with Paper and Blue Ink for Book," which achieved a remarkable $62 per square centimeter, for a total hammer price of $38,000. Created in 1980, this lithograph is a prime example of Hockney’s enduring fascination with the motif of pools, a subject that continues to captivate collectors with its iconic status within his oeuvre.

Following Hockney, we find Henri Matisse's "Envelope to Docteur Léon Vassaux" (Lot 183) with a price of $45 per square centimeter. Selling for $7,500, the piece dates back to 1952 and offers an intimate glimpse into Matisse’s practice, highlighting the demand for his works that extend beyond his primary canvases.

Andy Warhol features prominently in this list with several lots, notably "Rose" (Lot 277) and "Moonwalk" (Lot 166) commanding $40 and $39 per square centimeter, respectively. "Rose," achieving a hammer price of $9,000, and "Moonwalk," reaching an impressive $365,000, reflect Warhol's significant presence in the market and the high premium placed on his works, regardless of size.

Wallace Berman's "Untitled" work (Lot 389), priced at $31 per square centimeter and sold for $31,000, alongside multiple entries by Warhol, including Lots 174, 172, and 275, shows a broad collector interest in both Warhol’s and Berman's unique visual languages.

Jean Dubuffet's "Argument XXXIV" (Lot 227) and Donald Judd's "Untitled (S. 251-54)" (Lot 147), both at $22 and $21 per square centimeter, respectively, underline the appreciation for post-war European and American minimalism, signifying the artists' important roles in their respective movements and the concentration of value in their artworks.

Jean-Michel Basquiat's "Untitled (from Leonardo)" (Lot 125) at $21 per square centimeter and George Grosz's "Ein Verbrechen (A Crime)" (Lot 126) at $20 per square centimeter represent the collectors' engagement with works that carry strong socio-political narratives, reflecting the continuing relevance of their commentary.

Lastly, Pablo Picasso's "Buste au corsage à carreaux (Bust with Check Cloth Blouse)" (Lot 105), despite its lower price per square centimeter of $18, reached a hammer price of $60,000, illustrating the breadth of Picasso's market appeal. The lower price per square centimeter compared to other lots could be due to the larger size of the piece, diluting the value across more square centimeters.

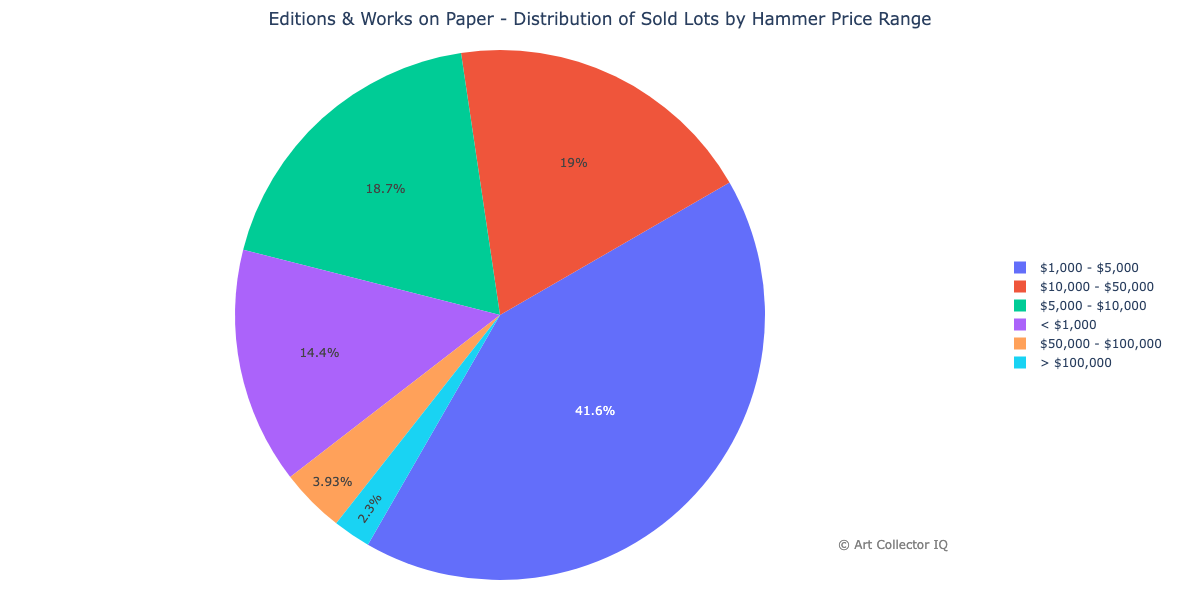

Sold Lots by Hammer Price Range

The first chart shows the count and percentage of lots sold in various price ranges. With 127 lots, or 41.64% of the total, falling within the $1,000 - $5,000 range, it's evident that this was the most populated segment of the auction. This suggests a strong market for more accessible works, likely appealing to a broader base of collectors, possibly including emerging collectors or those seeking to diversify their portfolios with lower-priced works.

The next significant segment was the $10,000 - $50,000 price range, with 58 lots accounting for 19.02% of the total sold. The $5,000 - $10,000 range closely follows with 57 lots making up 18.69%. These segments indicate a healthy middle market where more serious collectors are active, reflecting a demand for works that are perceived as having both artistic value and potential investment quality.

The lesser number of lots, 44 (14.43%), sold for less than $1,000. This segment might include works by lesser-known artists or those with less secondary market presence. The $50,000 - $100,000 range, with 12 lots (3.93%), and particularly the high-end bracket of over $100,000 with 7 lots (2.30%), represent the auction's premium segment, where top-tier collectors compete for highly sought-after works.

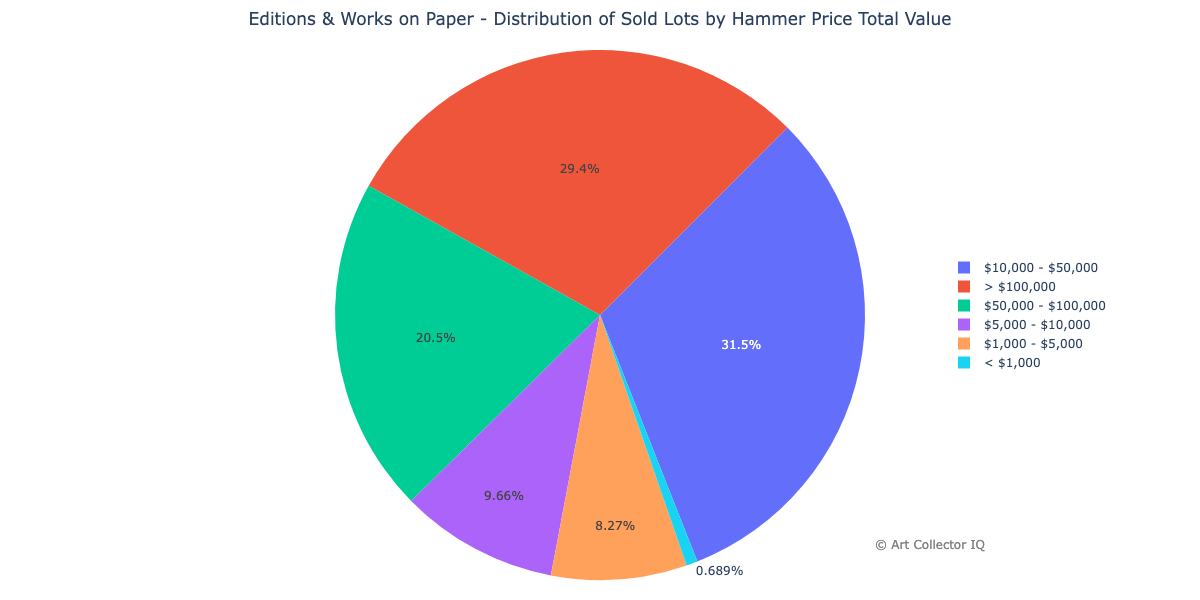

Distribution of Sold Lots by Hammer Price Total Value

The second chart delineates the total value and percentage of total value that each price range contributed to the auction. Interestingly, while the high-end segments represent a small fraction of the lot count, their contribution to the total value is disproportionately large.

Lots priced over $100,000 comprised just 2.30% of the number of lots sold but contributed a substantial 29.39% to the total value. This indicates that the high-value lots, despite their smaller numbers, generate a significant portion of the auction's revenue, reflecting the art market principle where a few high-value works can significantly impact the auction's financial success.

The $10,000 - $50,000 range, with 31.51% of the total value, reinforces its position as a critical market segment. The mid-tier collectors appear to be the backbone of the auction's financial structure, supporting the bulk of the auction's total sales.

Interestingly, the $1,000 - $5,000 range, despite having the highest number of lots sold, contributes only 8.27% to the total value. This underscores the point that while accessible art can drive volume, it does not necessarily drive the auction's revenue.

In contrast, the lower end of the market, under $1,000, made a negligible impact on the total value, accounting for a mere 0.69%.

Artist Analysis

Top Performers by Total Sales

Andy Warhol clearly dominates the auction with total sales amounting to $1,243,800 across 37 lots, solidifying his status as a perennial favorite in the art market. Warhol's works command an average price of $33,616.22, an impressive figure that, however, is not the highest average price achieved in the auction. This demonstrates the sheer volume of Warhol's works available and their consistent demand among collectors.

Roy Lichtenstein and Ed Ruscha also show strong results with total sales of $480,100 and $237,800 respectively, and with Ruscha's nine lots averaging $26,422.22, indicating a strong collector interest in their distinctive styles.

Top Artists by Lots Sold

The volume of lots sold also speaks to an artist's market presence and the availability of their works. Joan Miró, with 19 lots sold, although not reaching the total sales figures of Warhol, still represents a significant portion of the auction with an average price of $5,986.86 per lot. This suggests Miró's works have a widespread collector base which might be due to his long and prolific career offering a variety of works in terms of medium and period.

Top Artists by Average Selling Price

The table showing the top artists by average selling price reveals Jean-Michel Basquiat and Donald Judd leading with an average of $140,000 per lot, suggesting that their works are highly prized, fetching top dollar even when offered less frequently. Dan Flavin and Raymond Pettibon follow, with averages of $84,000 and $80,000 respectively, demonstrating the significant value placed on their limited offerings.

Analysis and Market Implications

Warhol's dominance in both total sales and the number of lots sold highlights his mass appeal and the wide distribution of his works within the market. His average price being lower than that of artists like Basquiat and Judd, who had the highest average prices but lower lot counts, indicates a market that is nuanced; one that values rarity and historical significance highly.

Miró's large number of sold lots suggests that his works, while not achieving the top prices, have a steady and reliable market. This may be due to the accessibility and variety of his works, which often appeal to a diverse range of collectors.

The unsold works by artists like Sam Francis and Terry Winters, while reflecting a limited appeal during this particular auction, might also indicate opportunities for collectors. The fact that these works did not sell could be used by savvy collectors as leverage for negotiating future purchases of these artists' works.

Collector Recommendations

- Diversify with Warhol: Given his market performance, collectors should consider diversifying their portfolios with Andy Warhol's works, ranging from high-value pieces to more accessible lots.

- Mid-Range Market Investment: Engage in the $1,000 - $50,000 segment for a balanced approach, taking advantage of the market's depth and resilience.

- Target High-Quality Lots: High-quality works by top artists like Basquiat and Judd, despite their higher price points, represent strong long-term investment opportunities.

- Monitor Unsold Opportunities: Unsold lots may offer negotiation leverage in post-auction deals, potentially allowing collectors to acquire works below their estimated values.

- Consider Emerging Segments: With the success of diverse mediums and less prominent names, collectors should not overlook the potential of emerging artists or less conventional works as part of a broader investment strategy.