Sotheby's - Digital Art Day Sale

April 9th - New York

Executive Summary

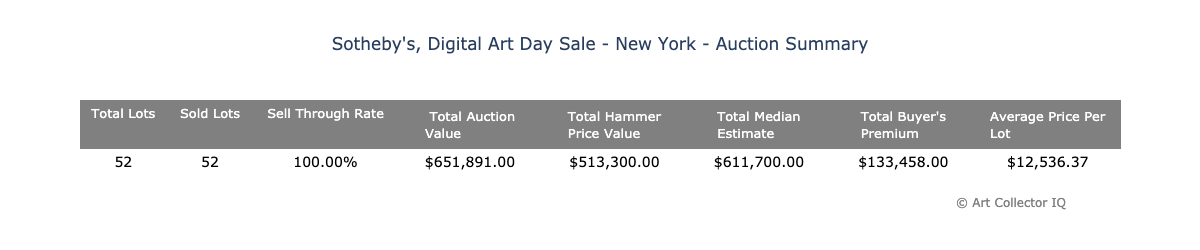

The Sotheby's Digital Art Day Sale demonstrated the digital art market's vibrancy and continued growth. With a 100% sell-through rate, the auction featured 52 lots and generated a total auction value of $651,891. The auction's success was characterized by strong demand across a spectrum of price ranges and styles, reflecting a diverse collector base.

Key Insights

- Diverse Price Point Appeal: The bulk of sales occurred in the mid-range price brackets ($1,000 - $50,000), with the $10,000 - $50,000 range accounting for the largest portion of the auction's total value (47.15%). This indicates a solid middle market.

- High-Value Leaders: Tyler Hobbs emerged as the top performer, with the highest total sales by hammer price and average price per lot, suggesting a high market value placed on his works.

- Surpassing Estimates: The Igloo Company and Herbert Franke Math Art had lots exceeding pre-sale median estimates significantly, indicating strong market interest and possibly a collector preference for certain themes or styles.

- Emerging Artists' Presence: Artists like Aaron Penne and Matt DesLauriers had the highest lot count sold, pointing to a healthy interest in more accessible art pieces, which is crucial for sustaining a dynamic market.

- Collectible Series: Series such as "Fidenza" by Tyler Hobbs and "Pudgy Penguins" by The Igloo Company showed strong performance, reinforcing the collectibility factor in the digital art realm.

- Unsold Lots: The absence of unsold lots suggests precise auction curation and a well-matched supply and demand in the digital art market.

Auction Overview

The Sotheby's Digital Art Day Sale in New York shows that all 52 lots offered at the auction were sold, resulting in a sell-through rate of 100%. This is an excellent outcome, indicating strong demand and possibly well-chosen lots for the sale. The total auction value reached $651,891.00, while the total hammer price value stood at $513,300.00. It's important to note that the hammer price is the price at which the auctioneer's gavel falls, marking the agreement of the sale. This price does not include the buyer's premium, which in this case, totals $133,458.00. Adding the buyer's premium to the hammer price results in the final auction value.

The total median estimate for all lots was $611,700.00. The hammer price being lower than the median estimate indicates that the lots, on average, sold for less than their estimated values. However, the strong sell-through rate could imply that the estimates were slightly optimistic or that the strategy was to attract buyers with more attractive estimates, leading to competitive bidding that ensured all lots were sold.

The average price per lot is calculated to be $12,536.37. This figure offers a straightforward insight into the general price range for the lots sold. This average is useful for comparing to individual lot prices to gauge which lots performed above or below the average.

In terms of auction dynamics, the 100% sell-through rate is a particularly striking detail, as it suggests that the auction was likely curated to fit the current market demand, or that the digital art market is experiencing a surge in interest. It may also reflect a well-executed promotional strategy by Sotheby's to attract a sufficient number of interested buyers or a broader acceptance and interest in digital art as a collectible asset class.

Lot Analysis

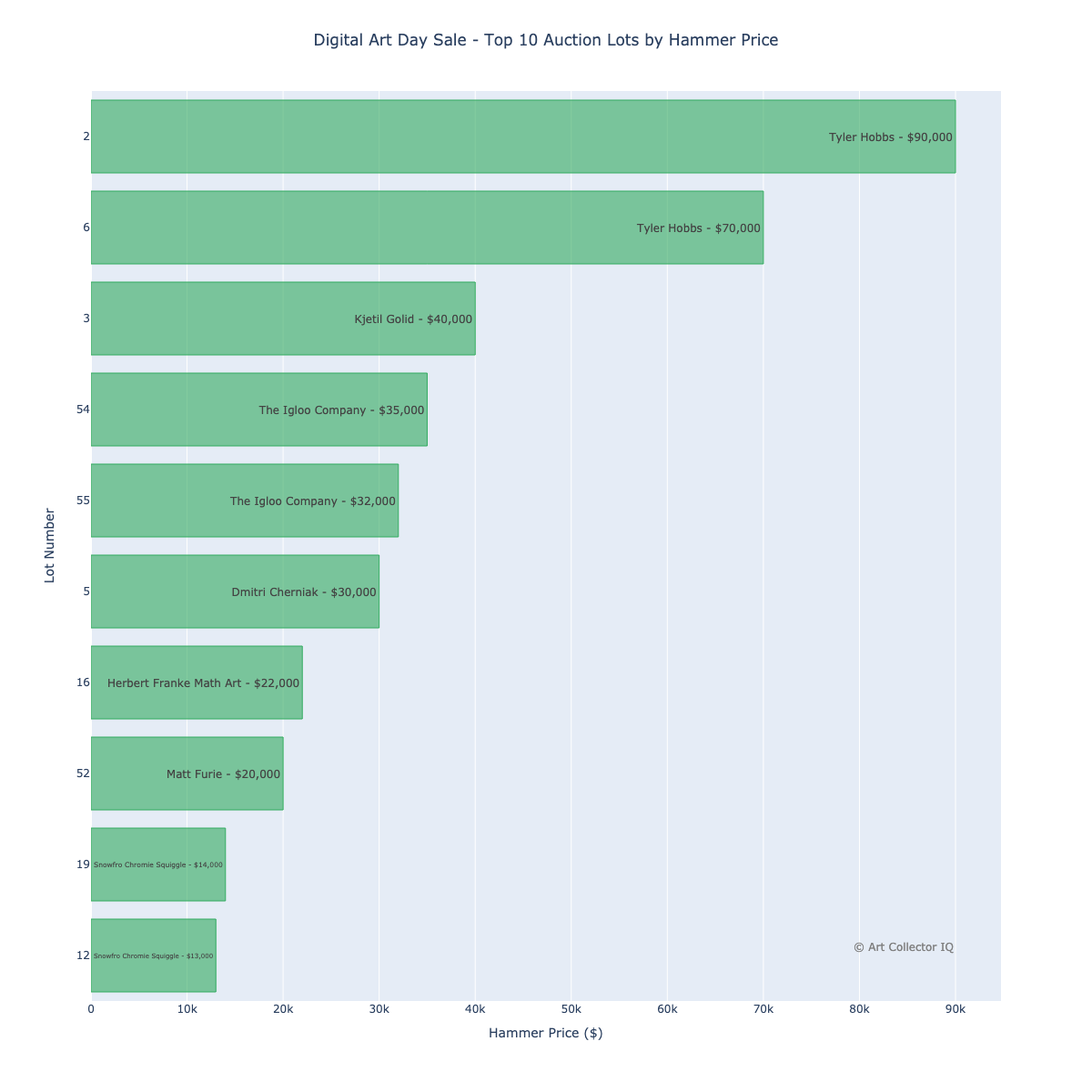

The highest hammer price achieved was for lot number 2 by Tyler Hobbs, titled "Fidenza #740," which sold for $90,000 against a median estimate of $120,000, which is 75% of the estimated value. This indicates that while it was the top lot, it sold for less than what was anticipated, suggesting that either the estimate was ambitious or the market valuation was lower than expected. Similarly, another piece by the same artist, "Fidenza #180" (lot number 6), also sold below its estimated value at $70,000 with a median estimate of $125,000 (56% of the estimated value).

Kjetil Golid's "Archetype #240" (lot number 3) sold for $40,000, which is approximately 57% of its $70,000 median estimate. This may suggest a trend where the highest-valued lots were estimated optimistically or that the market for certain high-profile digital artworks is becoming more conservative.

It's notable that two artworks by The Igloo Company, both featuring 'Pudgy Penguin' (#4636 and #6167), sold at the hammer price of $35,000 and $32,000 respectively, significantly exceeding their median estimates of $17,500 each. This suggests a strong market interest in the 'Pudgy Penguin' series, which performed notably better than estimated, potentially due to the popularity or collectability of these specific digital pieces.

Dmitri Cherniak's "The Wrapture #41" (lot number 5) realized $30,000 at the hammer, which is 60% of the median estimate. The artwork created in 2021 suggests that more recent works are among the top lots, perhaps indicating a trend towards contemporary digital art.

Herbert Franke, contributed "Math Art (1980-1995) - Math Art 95 - No. 83" (lot number 16), selling for $22,000 against a low estimate of $4,000, showing an impressive 550% of the median estimate. This lot's performance is significant and suggests a strong interest in Herbert Franke's work or perhaps the mathematical aspect of the art, given it greatly surpassed the estimate.

Another lot by Mat Furie, "FEELSGOODMAN Series 20, Card 50" (lot number 52), also performed well, fetching $20,000, which is 160% of its estimated $12,500. This could reflect a specific collector interest or a broader trend in the digital collectibles space.

Snowfro's "Chromie Squiggle #8306" and "Chromie Squiggle #9580" (lots 19 and 12) both sold for slightly below their median estimates, achieving 80% and 87% of their estimated values respectively. Given that both works are from 2020, it suggests that while they are amongst the top lots, the valuations have been very close to market expectations, potentially indicating a maturing market segment for Snowfro's works.

The lot with the highest percentage over its median estimate is lot number 33 by Divergence (artist name convergence), titled "COMPOSITE II" which achieved a hammer price of $2,000 against a median estimate of $250, marking a 700% deviation over its estimate. This substantial overperformance suggests a highly competitive bidding process, potentially driven by the piece's desirability or uniqueness.

Aaron Penne's artwork "Apparitions #589" (lot 35) also performed impressively, with a hammer price of $1,000 on a median estimate of $150, resulting in 567% over its estimate. This lot, along with the previous, indicates a possible trend where lesser-known or emerging artists are fetching prices well above expectations, a sign of a vibrant and possibly speculative market for new entrants.

Herbert Franke’s "Math Art (1980-1995) - Math Art 95 - No. 83" (lot 16) appears again, as it not only was one of the top hammer prices but also exceeded its median estimate by 450%, solidifying its status as a highly sought-after piece in this sale.

Monica Rizzoli's "Fragments of an Infinite Field #8" (lot 26) and "Fragments of an Infinite Field #421" (lot 13) both exceeded their median estimates by 380% and 260% respectively. This strong performance could be attributed to the appeal of Rizzoli's series or a particular collector interest in her work.

Joshua Bagley’s "Dreams #316" (lot 42) with a 340% over estimate and Han & Nicolas Daniel’s "Algorythms #8584" (lot 49) with a 305% over estimate indicate that certain themes or styles may resonate strongly with collectors, resulting in high competitive bidding.

Rafael Rozendaal's "Endless Nameless #736" (lot 43) and "Return #2117" (lot 40) also saw significant deviations of 260% and 200%. Such consistent overperformance across multiple works suggests a well-established collector base and interest in Rozendaal's art.

Darien Brito’s "Pigments #463" (lot 45) and "Pigments #708" (lot 46) performed notably above their estimates with 167% and 133% deviation. This could point to an increased interest in Brito's specific style or medium within the digital art sector.

Another notable mention is The Igloo Company’s "Pudgy Penguin #4636" (lot 54), which had also appeared in the top 10 lots by hammer price, surpassing its median estimate by 100%.

Finally, lot number 29 by Hideki Tsukamoto, "Cypher #485," while having the lowest hammer price on this list at $300, still managed to go 100% above its estimate, showcasing that even lower-priced lots can greatly exceed expectations.

Lot 53, by Johnathan Schultz titled "Golden Life of an Uncommon Pudgy," had a hammer price of $6,500, which is 52% of its median estimate of $12,500. This is the smallest deviation in the list, indicating that while this artwork did not meet its estimated value, it was not as significantly undervalued as other lots.

Tyler Hobbs' "Fidenza #180" (lot 6) and "Fidenza #740" (lot 2) appear here as well, showing that these pieces not only were in the top lots by hammer price but also did not reach their estimated values, achieving only 56% and 75% of their estimates respectively. This discrepancy between the high hammer price and the percent deviation suggests that while they were expected to be leading lots, the market did not value them as highly as estimated.

"Archetype #240" and "Archetype #332" by Kjetil Golid (lots 3 and 4) both sold for 57% and 75% of their median estimates, respectively. Despite being among the top lots by hammer price, these lots also did not meet their expected values, suggesting that the artist's works were priced optimistically or that there might be a variance in collector interest for different pieces by the same artist.

Dmitri Cherniak's "The Wrapture #41" (lot 5) garnered a hammer price that was 60% of the estimated value, reinforcing the trend that even some of the higher-demand works did not fulfill auction expectations.

Snowfro’s "Chromie Squiggle #9175" (lot 31) achieved 67% of its estimate, and Luxpris' "Elevated Deconstructions #50" (lot 7) reached 73%. Both indicate a lesser but notable discrepancy between market value and the estimates.

Darkfarms Bestiarum's "Bestiarum enriched with death" (lot 51) and Matt DesLauriers' "Meridian #943" (lot 9) both underperformed at 74% and 75% of their median estimates, indicating a potential overestimation of market interest or value.

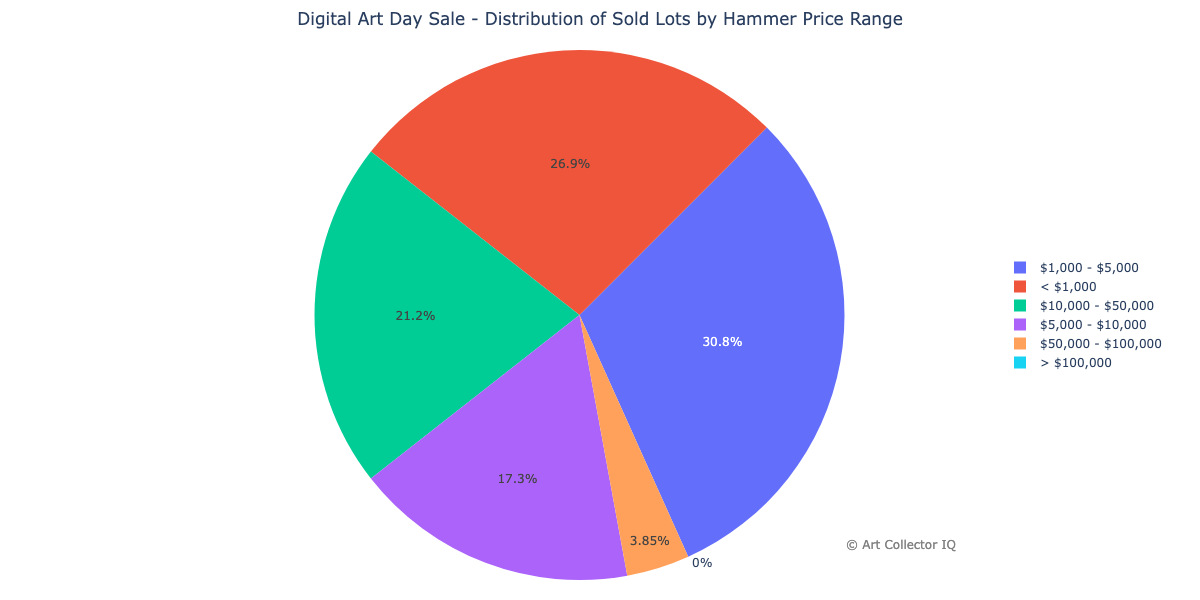

The majority of the lots were sold in the lower to middle price ranges. Specifically, the $1,000 - $5,000 price range contains the highest number of sold lots at 16, which is approximately 30.77% of all lots. This indicates that there was a strong market for digital artworks within this accessible price bracket.

The next significant category is the $10,000 - $50,000 range, with 11 lots sold, accounting for 21.15% of the total lots. This suggests that while fewer in number, there is still a substantial market for higher-priced digital art.

The $5,000 - $10,000 price bracket and the <$1,000 bracket also show significant activity, with 17.31% and 26.92% of the lots sold, respectively.

It's noteworthy that the higher price brackets, $50,000 - $100,000, had only 2 lots sold, and there were no sales above $100,000. This absence of ultra-high sales might reflect a current ceiling in the willingness to pay for digital art at this auction or a more conservative approach by collectors in the digital art market.

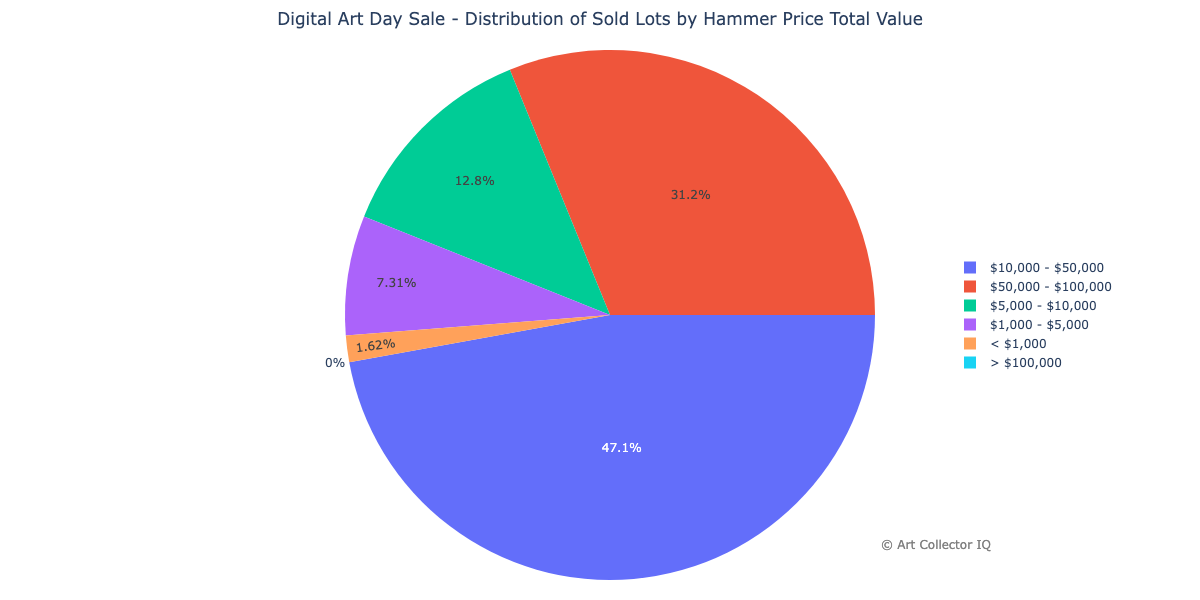

The $10,000 - $50,000 price range contributed the largest portion of the auction's total value, at 47.15%. Although fewer lots were sold at this price point compared to lower ranges, the overall value they represent is significant.

The $50,000 - $100,000 range, despite only containing 2 lots, represents the second-largest percentage of the total auction value at 31.17%. This demonstrates that a small number of high-value lots can considerably influence the auction's financial outcome.

Lower price ranges, such as <$1,000 and $1,000 - $5,000, contribute relatively little to the total value, 1.62% and 7.31% respectively, despite making up a significant proportion of the lots sold.

No lots were sold for more than $100,000, which indicates that the top end of the market did not participate in this particular sale, or that the lots on offer did not reach into the highest echelons of digital art pricing.

These charts collectively suggest a digital art market with a broad base of interest, particularly in the mid-price ranges. Most of the auction's financial success came from a middle bracket of the market rather than from headline-grabbing high-value sales. The absence of sales over $100,000 might indicate a cautious approach from collectors at the high end or a lack of works perceived to be of such value. Additionally, the high number of sales in the lower price brackets reflects a democratic nature of the digital art market, allowing a wider range of collectors to participate. The strength in the mid-tier price range may be a positive sign of market depth and collector commitment to the digital art genre.

Artist Analysis

Tyler Hobbs emerges as the top-selling artist by total hammer price, having two lots sold for a combined total of $160,000. This total places Hobbs at the forefront of the digital art sale, commanding an average price of $80,000 per lot. Such high returns per lot suggest a strong collector demand for Hobbs's work, potentially owing to his reputation or the uniqueness of his digital creations.

Following Hobbs, The Igloo Company's two lots brought in $67,000, with an average of $33,500 per lot. Snowfro Chromie Squiggle with four lots sold accumulated $49,000, averaging $12,250 each, indicating a broader but less lucrative appeal compared to Hobbs.

Kjetil Golid’s works, though only two lots were sold, garnered a significant total of $47,500, giving us an average price of $23,750 per lot. The performance of Golid’s work demonstrates a strong interest, although with fewer works sold compared to Snowfro, it could suggest a higher individual value or perhaps a niche appeal.

In terms of lot count, Aaron Penne and Matt DesLauriers stand out with five lots each, though their total hammer prices are modest compared to top earners, indicating that they have multiple works available but at more accessible price points.

In assessing the average selling price, Tyler Hobbs maintains the lead, reinforcing the notion of high desirability for his art. Notably, The Igloo Company and Dmitri Cherniak's average prices also reflect a robust interest. Herbert Franke Math Art, with only one lot sold, reached an average of $22,000, suggesting that particular works can command significant attention, possibly due to their unique characteristics or the reputation of the artist.

Across these metrics, we observe a digital art market that rewards both established names and emerging artists. While certain artists like Tyler Hobbs drive the high end of the market, others contribute to a vibrant and diverse marketplace. It’s evident that the digital art space is not solely dictated by high-value transactions but is also supported by a significant volume of sales in the mid to lower price ranges, ensuring broad market participation.

Collector Recommendations

- Diversify Investments: Considering the success across various price points, collectors should consider diversifying their portfolios to include both mid-range and high-value digital artworks.

- Monitor Emerging Talent: Given the strong performance of emerging artists, collectors are advised to keep a close watch on new entrants to the market for potential high-return investments.

- Value Recognition: Be mindful of series or themes that exceed estimates as they may represent a strategic investment opportunity, given their potential to outperform market expectations.

- Artist Track Records: Artists like Tyler Hobbs who have a consistent record of high sales might be a safer but potentially more expensive investment, appealing for both aesthetic value and potential long-term return.

- Active Participation: With the wide range of price accessibility, collectors at all levels are encouraged to participate in the digital art market to support its growth and vitality.